Don’t Count on Housing Again

August 23, 2010 Leave a comment

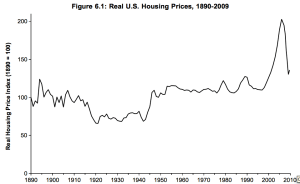

Please see the excellent post in The Baseline Scenario (for my money one of the best economics and financial blogs around) where housing is evaluated as a bad personal investment. The graph shows that housing values remained more or less flat for years in real terms (adjusted for inflation) and then we had the bubble and its collapse.

Friends of Coral Gables–Do not count on your house ever becoming again an ATM for you and the city (via higher taxes). All future tax increases will come straight out of your pocket.

…I don’t think it’s correct to say that an era is over–an era when housing appreciation was the key to the economy. The chart above shows simply that that era never existed; housing was flat for a long time, and then there was a bubble. Instead, we had the illusion of an era of housing appreciation, produced mainly by leverage and price illusion. For every homeowner who made a killing because she got a fixed-rate mortgage in 1970, there was a new family that couldn’t afford a house in 1980 because interest rates were too high, or a savings and loan that failed because it was weighed down by those fixed-rate mortgages. That whole phenomenon was just a transfer of wealth within society.